Everyone understands that new cars lose their value quickly, but I was curious to know whether mountain bikes depreciate in the same way. So, I researched sales prices from completed eBay auctions for nearly 100 popular mountain bikes, and also noted bike values on BicycleBluebook.com to double-check my work. Here’s what I found.

Mountain Bike Values Tank in Year 1

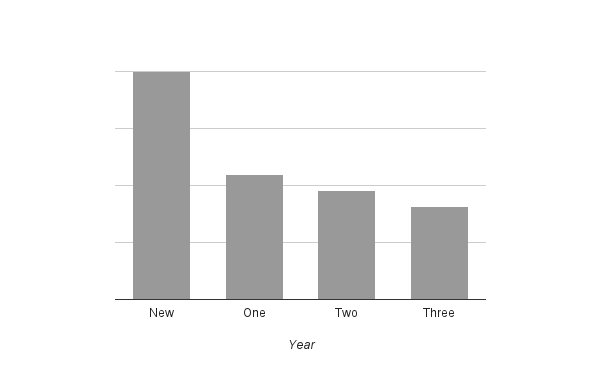

For this analysis, I looked at popular mountain bikes from Trek, Specialized, Giant, and Santa Cruz, since these companies tend to sell the most new bikes, and therefore there is a good supply of bikes from these brands being sold used. On average, these brands’ year-old, 2016 mountain bikes, are currently selling for 45% of their original MSRPs. Interestingly, there isn’t much of a difference between the brands: the brand with the worst, year-1 resale average decline is 46%, while the best brand is 44%. This makes me think the 45% decline might just be universal.

Compared to new car depreciation, mountain bikes are in a class of their own. According to CarFax, new vehicles lose (just) 15-25% of their value each year. Cars also lose 10% of their value in year 0, which is basically the value lost the moment the car drives off the lot. I only found one current year, 2017 bike on my list that sold on eBay at the time of publication, but sadly that one sold for 47% less than the MSRP. (Note to self: stalk eBay for current model year bikes and buy them.)

Of course, not everyone pays full MSRP for a new bike to begin with, so these losses might not be as bad as they seem. I’ve always negotiated new bike purchases with my local bike shop, and my guess is others do too. I don’t have any solid numbers on the actual sales prices for new bikes compared to their list prices, but my guess is current model year bikes get discounted by 10% at most through negotiation, promotions, etc.

Shop employees and others in the industry do get larger discounts off list prices, so this may put some additional pressure on used bike sales. Many companies that offer industry discounts stipulate that the bike can never be re-sold for this very reason. So, my guess is while some used bikes on the market were purchased at a significant discount, the majority of the used bikes being sold are not. Even if many of the bikes are being sold by industry folks, it doesn’t change the fact that if you’re trying to sell your bike, you have to price it according to the going market rate.

What About After Year 1?

The good news is, mountain bike values appear to stabilize somewhat in years 2 and 3. According to my research, 2-year-old bikes are selling 52% below their original MSRP, which is just a 7% decrease from the year 1 value. Year 3 is surprisingly similar, showing bikes losing another 7%, landing at 59% off MSRP.

Admittedly I found fewer 2- and 3-year-old bikes in my research set, but looking at the value ranges BicycleBluebook.com provides for similar bikes, this seems to be pretty close to accurate. Rather than provide an average sales price for used bike models, BicycleBluebook.com gives several value ranges based on a bike’s condition. For example, of the models I checked, on average, in year 1, bikes lost 38% of their value if they were in excellent condition compared to 62% if they were only in fair condition. Looking at the change from year 1 to year 2, the examples I pulled from BicycleBluebook.com lost an additional 5-7%, and another 2-4% from year 2 to year 3.

[see_also id=”186304″][/see_also]

Beyond year 3 I wasn’t able to come up with a lot of good data, though that data certainly exists. My hypothesis is there is another sharp drop in a bike’s value once it gets beyond a certain age due to the obsolescence of parts or technologies, and the fact that the bike has likely seen significant wear and tear in that time.

Caveats

As I stated earlier, this analysis only looked at about 100 eBay sales completed in January, 2017, and only focused on about six popular mountain bike models from top brands. Of course there are plenty of other places people sell used bikes other than eBay, so pricing might be better or worse for other channels. It’s also possible that January is a particularly bad — or good — time for selling used bikes, which could skew these results.

Then, there’s the matter of component upgrades. Finding two used bikes that are completely identical in parts spec is virtually impossible since owners regularly swap out parts due to damage or personal preference. Just skimming through the listings I included in my data set, I got the sense that if anything, the bikes being sold included parts that were as nice or nicer than those that came stock, but again, this isn’t quantified in the results. It’s also difficult to quantify how hard a bike has been ridden, though the BicycleBluebook value guide does attempt to quantify this a bit by giving value ranges based on bike condition.

Bottom Line

Every used bike on the market is different, and for that reason there is a wide range of expected resale values for each one. But if you’re banking on trading in your new mountain bike after riding it for just one year, think again. Even though mountain bikes appear to lose much of their monetary value over time, that doesn’t mean our enjoyment has to wane. It’s still up to the rider to maximize time in the saddle to soak up all the real value!

What’s your experience: Have you ever bought or sold a used bike for a crazy low or crazy high price?

24 Comments

Feb 3, 2017

I've had some success in buying new but last years' models:

In 2003 I bought my ex a 2002 Gary Fisher Sugar 3+ for $900 ($1600 new) but I had cash and the frame was a small...so the LBS was very motivated to sell. In 2012 I purchased a 2011 Felt Z4 road bike ($3K new) for $1400, but I had to buy a Cateye computer at full price to seal the deal.

My last two purchases from Trek (2013) and Pivot(2016) have been at full price. A result of my arrogance,greed,lust I convinced myself that I "needed" and "deserved" them. They are superb bikes and a joy to ride.......but I paid -way- too much.

For what it's worth I'm taping this article to my 'fridge as I'm in the market for a gravel bike this year and your analysis should keep me out of the new, shiny and expensive market. ;-)

Feb 3, 2017

Jan 26, 2025

Jan 27, 2025

Feb 9, 2017

Lastly, in the vintage world (all my bikes), a 1991 Salsa a la carte or WTB Phoenix can sell for more now than when they were new! Dig it and ride on

Feb 9, 2017

Feb 3, 2017

Me...I ride my bikes until they are dead or obsolete. I look at the "investment" potential in ways other than monetary. Such as...will it allow me to grow, progress, ride as hard as I want and where I want? Does it allow me to get out there and experience?

I have always felt bike (and cars) a poor financial investment. They are tools to facilitate experiences. But for those that often "horse trade" this is all good info!

Ride hard, but safe!

Feb 3, 2017

Feb 3, 2017

Recently a friend sold his year old Trek Fuel Ex for $6,000. On his way home another driver knocked his vehicle off an Interstate highway and failed to stop. The authorities were more interested in his possession of a large amount of cash than his injuries when they first arrived.

Feb 3, 2017

How this saved the day: A few months ago, I bought a bike from one of the mechanics at my LBS. Even though I knew and trusted him, I went through this same procedure. Shortly thereafter, he bought a house. When the bank reviewed his bank statements, they saw a large deposit that raised a red flag -- banks don't like to see an unexplained deposit because it could be a loan from family, etc. to enable someone who wouldn't otherwise be able to afford a house to get the down payment

My mechanic was able to provide a copy of the cashier's check and his original bill of sale, which gave the bank a way to verify that this was a legitimate transaction and not a loan. He wouldn't have gotten the mortgage if he hadn't been able to show the source of that money with credible documentation.

Feb 4, 2017

So the 45% consisted of 20% VAT and 25% discount. I imported from the bike out of the UK from the Bike Depot. They are based in Halifax. There were tons of deals when I bought in Oct 2016. Plus, sterling is down after the decision to leave Europe.

The Trek I sold held its price, since when I bought it i swapped the fork, wheels and drive train. When I sold it the original parts were essentially new. Hence the good price. The Scott Genius I regret selling. It was discounted 20% from new, which was already reduced. I removed the wheels and seat and post and some other items. They were refitted when I sold bike. Both bikes had cosmetic paint damage long mountainous rides.

Don't move much if at all on the sale price as there is no rush to sell. All three bike, a second Trek, we're advertised on another bike site. They took sometime to sell.

Feb 3, 2017

I have to disagree. Last year I sold two bikes and lost average of 15%. One I had ridden for just over three years an the other for over year.

My latest bike was bought new online but came discounted 45%.

Regards.

Dec 2, 2018

Feb 3, 2017

Feb 4, 2017

I have replied this evening. No speculation Kid Charlemagne... Here is the site I bought my last bike from. https://www.ukbikesdepot.com. It arrived within a week. The secret is buy low, sell high. I love haggling over purchases.

In live Calgary and I had plenty of people contacting me. Interestingly through, only the people that bothered to come and try the bikes bought them. Since we are now in recession I guess there could be a number second hand bike deals.

Feb 3, 2017

1) The sales are executed in a market where there is less information about "true prices." eBay is what we Wall Street types call a "liquid" market -- there's enough sales that you can get good data about the "true" market price of a given bike. It's like the stock market -- everyone who wants to buy Microsoft stock must go to the same place, and the price reflects what everyone who might want to buy or sell Microsoft at that moment thinks about the value of the company. An illiquid market is one where there aren't a lot of buy/sell transactions so an efficient price isn't known, or the price can vary wildly. An example would be a few people sitting around a dining room table trying to buy and sell cards from each other's baseball card collection -- by comparisons, the prices of cards at a baseball card show are likely to be much more uniform for common cards.

So if "dpb1997" was selling common bikes from a leading manufacturer, he might have sold those bikes in a market where the buyer didn't have perfect information about the broader market for used bikes, and was thus happy to pay what the seller was asking.

2) Another explanation is that "dpb1997" was selling bikes in a market that structurally could be liquid (i.e., on eBay) but the bikes themselves were sufficiently rare or unusual that no efficient market price could be easily determined. In other words, "dpb1997" might be selling a bike from a small, up-and-coming manufacturer of really unique gravel bikes aimed at left-handed vegetarians, a very small slice of the market indeed. I've had this problem buying and selling certain pieces of rare collectible furniture on eBay -- the few sales of each piece over the last 5 years have varied wildly in price.

3) A third explanation is that the bike could have some external factor that would affect the price, such as a limited edition super-high-end bike or one that would involve a significant lead time from a custom frame builder. Even if mass-produced bikes drop 45% in the first year, you could probably sell a frame from one of those hot custom builders for more than you paid for it because of the time value of money, so that the buyer doesn't have to wait X number of years to take delivery. The long wait time keeps resale value of nearly-new Ferraris, private jets, etc., high.

There could be many other explanations as well. I'm at work, in Wall Street thinking mode, so these are what I am sort of biased to thinking about. Perhaps there are other non-financial explanations. Maybe "dpb1997" is just an amazingly enthuiastic and passionate salesperson who could sell ice to Eskimos.

Feb 4, 2017

Feb 3, 2017

Feb 18, 2017

Warranty is another factor. If you sell your car, the warranty doesn't disappear. With bikes and components, it does. Trek is typical: "[W]e build products to last a lifetime." Followed by: "Trek Bicycle provides the original retail purchaser of a Trek bicycle an amazing warranty." Presumably the sale negates the integrity of the product. If that product happens to be carbon with a lot of trick parts, flaws that might be invisible on first inspection can cause four-figure repair bills.

Industry trends also figure large. There are a lot of older XC superbikes with 2x drivetrains and skinny rims. One I evaluated was a Cannondale with an $8K MSRP five years ago. The resale value of the entire drivetrain on that bike, cranks excepted, was $130. The $2K carbon wheels, maybe $500. Worth is just what someone else will pay, and for some products, there just aren't that many interested buyers. Were I buying new this year, I wouldn't consider anything without Boost spacing, purely on the expectation of a future sale.

And then we've got perceived alternatives. If I want a carbon bar, I'm not going to buy someone's $200 Easton, I'll spend $30 and have a new one shipped from China. (I've bought five of these bars; in most cases, the quality is there.) Same with wheels. Above a certain price, you're paying for a name the warm fuzzy of assumed (and only assumed, because there are no quality metrics to say either way) superiority. Not everyone values that name, especially when, as above, used "name" products aren't supported at all.

A fourth factor alluded to above is the information disparity between buyer and seller. Was the bike abused? Was it maintained? When and by whom? Depending on the nature of the bike, knowing the history can be worth quite a lot.

Feb 3, 2017

Anecdotally, it seems boutique brands tend to hold better value. Also, I thought it was interesting that the 3 big brands you reviewed were so similar. What I've seen here is Giant plummets terribly while Specialized not so much. Geographic variances, maybe?

Lastly, changes in standards can be interesting. For example, 26ers quickly became worth very little even if new, but a bike without Boost is less affected it seems.

Curious what others have noticed as well.

Feb 4, 2017

Feb 3, 2017

I think what's happening here is that the market is correctly assessing the value of a one-year-old used mountain bike from a major maker. I think you're pointing to the underlying phenomenon: the resale value of last year's model is determined by the wholesale cost of new dealer stock of that same model. If you assume that the dealer's cost is 30% to 35% less than the sticker price of a bike (I don't know the bike industry well enough to know that, and the margin is likely to vary quite a bit on individual models), then that suggests that dealers blowing out last year's models at cost will set the price of the market.

While I've never bought a used bike on eBay, I have certainly shopped there, and looking at "other listings" for people selling new last year's model seem to be shops blowing out inventory, because most sellers of new 2015 and 2016 bikes have quite a few bikes for sale. So that makes it seem likely that these dealers are a significant force in the eBay market.

Used bikes will have to trade at a discount to new, of course. That would explain how you get from whatever the wholesale cost of a year-old bike is to the prices for used bikes. If I'm right about gross margin for bikes, another 10% discount for a bike with a couple hundred miles doesn't seem excessive.

One very interesting finding in your report was how tightly clustered prices were around the 45% level. This may be a function of sellers researching prices for prior sales and just setting the price at the last successful sale price rather than trying to be clever, figuring that investing several hours in trying to get a better price would not yield a return on the investment of time. Thus, the fact that bikes are consistently selling at the asking price of 45% off list might be evidence that sellers are under-pricing their bikes. If that's true, one way to determine whether the amount of under-pricing is significant is to look at the time o the market. If bikes sell quickly, then they're probably under-priced by a greater margin. If they sell closer to the end of the auction than to the date they were listed, then they may still be under-priced, but not by as sizable a margin.

Feb 3, 2017

Fantastic insights, thanks for chiming in Kid Charlemagne!

Feb 4, 2017